Auto OEMs & Auto Components Consulting Services

We offer consulting services to organizations engaged in manufacturing and distribution of automobiles or auto components. Our consulting methodology focuses on identifying the leverage point of an organization for intervention.

Operations & Supply-chain (for Automobile Sector)

Our Offer

Near

100%

availability of

automotive components

Upto

50%

Reduction in

lead time

Upto

95%

Increase in

on-time delivery

Upto

40%

Increase in

plant output

Upto

20%

Reduction in

overall inventory

Improved

cash-to-cash cycle

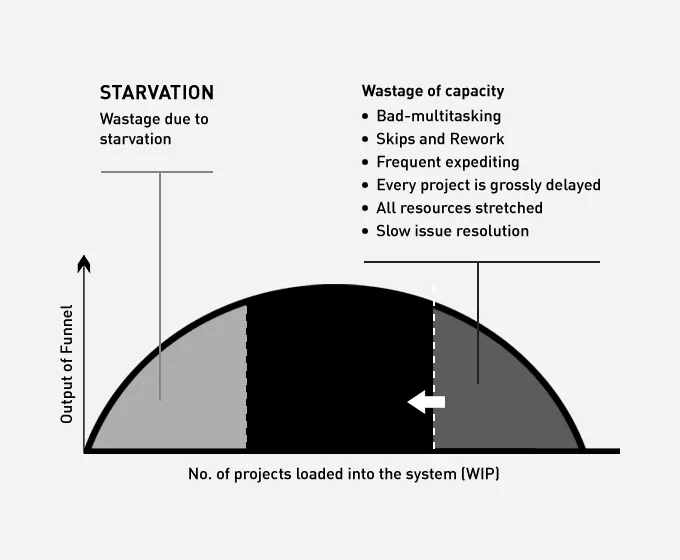

Plans of manufacturing plants in the automobile sector are sensitive to the slightest changes in the market and in the supply chain. Market upswing/downswing or disturbances in the supply chain cause the plants’ schedules to become unstable quickly. This is true for both automobile companies as well as Tier I auto component manufacturers. At times, despite the best efforts of the purchase managers, schedules may not stabilise for a day or a shift. This is because plants face a shortage of complete kits required for scheduled assembly for that day or the shift.

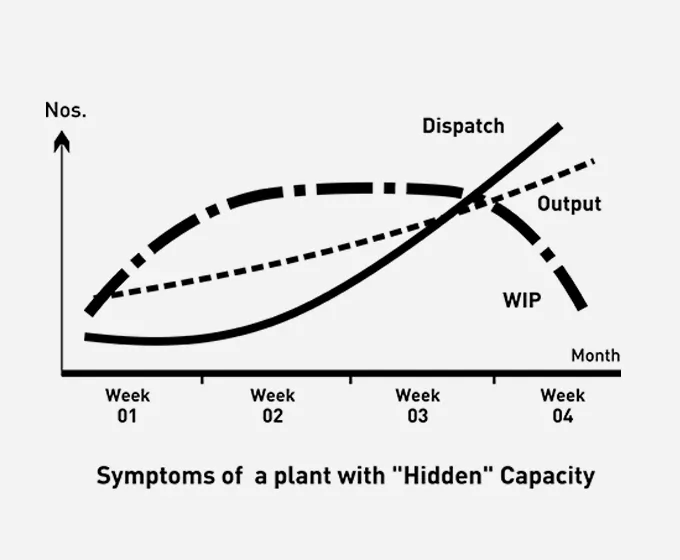

So, as the month progresses, the WIP of incomplete kits balloons; and at the month-end, when more kits are completed, it drops with a huge spike of dispatches in the last week. This relentless struggle to complete kits during the month, and the huge skew at the month-end, together lead to significant capacity wastage. This prevents automobile companies and automotive component manufacturers from exploiting the full potential of their plants.

In this situation, to keep their own inventory levels low, the stronger players in the supply chain (usually Automobile OEMs) tend to push the weaker players (usually automotive component manufacturers or dealers) to keep high inventory in the latter’s books and warehouses. On the surface, this might seem like a good bargain for OEMs, but it is not. Burdened by excess inventory, the component manufacturers will struggle to organise the relevant raw material or parts for the OEMs. This lack/mismatch of automotive components at the vendors’ or component manufacturer’s facility, in turn, leads to further rescheduling at the OEMs’ plants.

We at Vector Consulting Group offer our consulting and implementation expertise to both automobile OEMs and automotive component manufacturers. We enable manufacturing units to stabilize operations, increase plant output, and improve reliability. Find out how

Read More

Vehicle Distribution (for Automobile OEMs)

Our Offer

Near

100%

Improvement of availability

About

50%

Reduction in overall inventory

About

50%

Reduction in dealer inventory

Eliminate or reduce need for inventory liquidation sales

Near

80%

Increase dealer

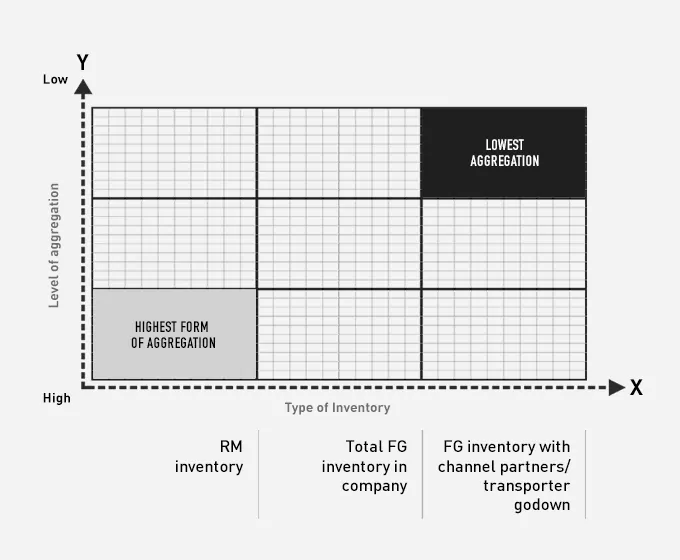

Unlike in the days of Henry Ford (a time when variety was limited), today’s automobile manufacturing companies offer a huge choice of variants to customers. Competition activity and norm changes also necessitate new product introductions at a faster rate than ever. Since dealers stock as per forecasts and OEM-prescribed sales targets for this large range of SKUs, each dealer would have very high finished goods stock tying up space and cash in his warehouse. However, in spite of the high inventory, some popular models quickly become stocked out (loss of sale) while many slow models (e.g. demand may have shifted to new variants) have to be discounted (loss of margin). Curiously, what is stocked out at one dealer may be in excess at another!

Vector Consulting helps clients address the problem of vehicle availability without the necessity of maintaining large inventories. Our custom solutions create a win-win reality for both automobile OEMs and dealers.

How can automobile companies ensure near-100% availability at less than half the inventory? Find out

Read More.webp)

Auto Components and Service

Our Offer

Enhance to near

100%

Availability of automotive components

By Around

25%

Reduced inventory in supply chain

Upto

20%

Increase sales of automotive components

More than

50%

Reduce turn-around-time

More than

90%

Increase on time performance

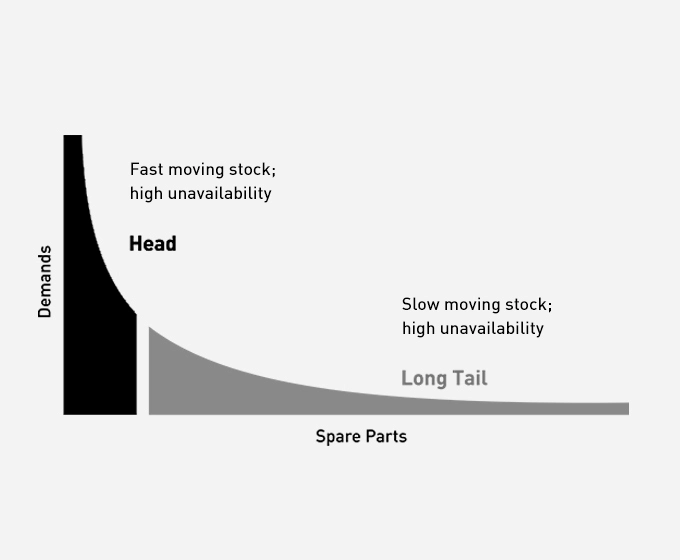

An automobile Original Equipment Manufacturers (OEM) spare parts business has to ensure delivery of components to customers exactly when they need them. However, ensuring component availability is a major challenge due to the enormous variety of automotive components involved across the portfolio of the Auto OEM’s vehicles. To complicate things further, some of these parts are needed very infrequently. Consequently, whenever OEMs try to improve component availability, the cash is tied up in slow-moving inventory balloons! So, most automobile OEMs in India struggle with trying to ensure component availability while ensuring financial viability.

Many OEMs and OESs distribute automotive components in the aftermarket through a network consisting of distributors and small retailers. Stock movement in the channel based on forecasts and targets creates its own challenges. Most distributors in the market are small businessmen who find it difficult to invest large sums as capital. When many automotive components are inherently slow-moving, the speed at which stock rotates deteriorates because the channel partner is exposed to a smaller demand and highly variable demand in a restricted geography. This impacts their ROI and their ability to restock when items are sold out. So, the daily working capital woes of a distributor force him to restrict his business; many tend to service only a limited number of retailers (mostly large ones) whom he perceives as low credit risk. These conditions adversely impact the last-mile availability of components.

At Vector Consulting, we have evolved innovative solutions, robust techniques and proven practices for addressing the long tail problem created by infrequently demanded automotive components.

Read More

Research & Development

Our Offer

Upto

50%

Reduced project lead time

Upto

50%

Increased output without additional resource

Enhance visibility and control over progress of projects

Reduce rework & improve quality of output

Rapid production stabilization

Reduced stress on people and other resources

In most auto R&D departments, the addition of resources does not keep pace with the increase in load. The enormous workload, the high uncertainty of the environment, and the heavy dependence on external suppliers make new product development in auto companies immensely challenging. The process is riddled with rework, delays in production stabilization, and delays in the launch. Even after launch, quality issues are not uncommon. Elevated stress levels of engineers are a serious concern.

Read More

Diagnostics Center

Is your inventory profile skewed on the wrong side – too much at a point where there is minimal aggregation and too less at the point of highest aggregation?'

To do a detailed diagnostic on your company,

take this test

Case Studies from Automobile Industry

Using the principle of pull-replenishment of Theory of Constraints, Vector Consulting Group has helped organizations like Tata Motors CVBU, Fleetguard Filters to build agile operations and achieve seamless distribution.

Clients

Vector Consulting Group has partnered with major names in the auto and auto components industry to create and implement radical solutions which have helped redefine industry benchmarks. These names include: